The EU economy staged a comeback at the start of the year, following a prolonged period of stagnation. Though the growth rate of 0.3% estimated for the first quarter of 2024 is still below estimated potential, it exceeded expectations. Activity in the euro area expanded at the same pace, marking the end of the mild recession experienced in the second half of last year. Meanwhile, inflation across the EU cooled further in the first quarter.

This Spring Forecast projects GDP growth in 2024 at 1.0% in the EU and 0.8% in the euro area. This is a slight uptick from the Winter 2024 interim Forecast for the EU, but unchanged for the euro area. EU GDP growth is forecast to improve to 1.6% in 2025, a downward revision of 0.1 pps. from winter. In the euro area, GDP growth in 2025 is projected to be slightly lower, at 1.4% – also marginally revised down. Importantly, almost all Member States are expected to return to growth in 2024. With economic expansion in the southern rim of the EU still outpacing growth in north and western Europe, economic convergence within the EU is set to progress further. On the 20th anniversary of the enlargement of the EU towards the east and the south, it is notable that, after almost stalling last year, economic convergence is also set to resume for the newer Member States. It is expected to continue at a sustained pace throughout the forecast horizon and beyond (see Special Topic).

HICP inflation is projected to continue declining over the forecast horizon. In the EU, it is now expected to decrease from 6.4% in 2023 to 2.7% in 2024 and 2.2% in 2025. In the euro area, it is forecast to fall from 5.4% in 2023 to 2.5% in 2024 and 2.1% in 2025. This is a downward revision compared to winter for both the EU and the euro area – especially for this year.

Economic activity broadly stagnated in 2023. Private consumption only grew by 0.4%. Despite robust employment and wage growth, labour incomes barely outpaced inflation. Moreover, households put aside a larger share of their disposable incomes than in 2022, as high interest rates kept the opportunity cost of consumption elevated, while high uncertainty, the erosion of the real value of wealth by inflation and the fall in real estate prices sustained precautionary savings. Investment grew by 1.5% in 2023, but largely driven by a sizeable carry-over from 2022. Especially towards the end of the year, weakness in investment was widespread across Member States and asset types, with a pronounced downsizing of the interest-rate-sensitive construction sector. External demand did not provide much support either, weighed down by a sharp slowdown in global merchandise trade. Still, with domestic demand stagnating, imports contracted more than exports, lifting the contribution of net external demand to real GDP growth to a sizable 0.7 pps. Last, but not least, the negative drag of an unusually strong inventory cycle detracted almost 1 pp. from domestic demand, and explains most of the over-estimation of real GDP growth in 2023 in previous forecasts. Meanwhile, HICP inflation has continued declining. From a peak of 10.6% in October 2022, inflation in the euro area is estimated to have reached 2.4% in April 2024. Inflation in the EU followed a similar path, with the March reading (April was still missing at the cut-off date of this forecast) coming in at 2.6%. Rapid fall in retail energy prices throughout 2023 was the main driver of the inflation decline, but underlying inflationary pressures started easing too in the second half of 2023, amidst the weak growth momentum.

Expectations for imminent and decisive rate cuts across the world have been pared back in recent weeks, as underlying inflationary pressures – especially in the US – have proved more persistent than previously expected. In the euro area, where the European Central Bank last hiked its policy interest rates in September 2023, markets now expect a more gradual pace of policy rate cuts than in winter. Euribor-3 months futures suggest that euro area short-term nominal interest rates will decrease from 4% to 3.2% by the end of the year and to 2.6% by the end of 2025.

Outside the euro area, central banks in some central and eastern European countries, as well as Sweden (after the cut-off date) have already embarked on a cycle of monetary policy easing.

Although retail interest rates have already started to come down, bank lending has so far failed to rebound, due to some further tightening of credit standards, but especially lower corporate demand for loans. However, as interest rates keep falling, the conditions for a gradual expansion of investment activity remain in place and are even bolstered by the robust financial deleveraging in preceding quarters.

With prolonged weakness in the manufacturing sector leaving many plants operating below normal capacity utilisation rates, equipment investment is expected to expand only marginally this year (see Box I.2.1), before accelerating in 2025. Non-residential construction investment is expected to remain resilient, largely reflecting government infrastructure spending with RRF support. By contrast, housing investment is projected to continue contracting this as continued fall in house prices and a still large build-up of inventories weigh on supply. The downsize of residential construction is set to continue in 2025, but the aggregate outlook masks significant variation across countries.

Despite largely stagnant output, the EU economy created more than two million jobs in 2023, thanks to broad-based employment growth across the EU. According to the Labour Force Survey, the employment rate of people aged 20-64 in the EU hit the new record high of 75.5% in the last quarter of 2023.

Notwithstanding evidence of cooling demand, the labour market remains tight. In March the EU unemployment rate stood at its record low of 6.0%, and other measures of labour market slack remain near record-low levels. Furthermore, the unemployment rate continued falling in Member States recording the highest rates, resulting in continued decline of dispersion across countries. This strong labour market performance reflects favourable developments in both labour demand and labour supply, also due to migration. Going forward, the impulse of these positive drivers is set to abate, and employment growth is expected to be more subdued. Over the forecast horizon, however, the EU economy is still expected to generate another 2.5 million jobs, while the unemployment rate should hover around the current record-low rates. Nominal compensation per employee expanded by 5.8% in 2023 in the EU, with a gradual deceleration in the second half of the year. It is projected to decelerate further throughout the forecast horizon, alleviating underlying inflationary pressures. Importantly, growth in real wages – which started towards the end of last year – is set to continue throughout the forecast horizon. By 2025, average real wages are set to fully recover their 2021 levels, though this is not the case for all Member States.

Continued wage and employment growth will sustain growth in disposable income in 2024. A further uptick in the saving rate to 14.4% however limits the expansion of private consumption to 1.3% – still well below trend growth. In 2025, real disposable income is set to accelerate further, while the decline in interest rates reduces incentives to save. This is set to deliver a more sustained consumption growth, at 1.7% in the EU.

Despite facing headwinds from persistent inflation and restrictive monetary policies, growth outside of the EU remained resilient throughout 2023.

However, it failed to spur demand for EU exports. Factors such as the post-pandemic rotation of consumer demand from goods to services, inventory depletion in advanced economies, and tightened monetary conditions impacting trade-intensive capital goods together contributed to a significant downturn in global merchandise trade. In this lacklustre trade environment, the EU as a whole managed to gain export market shares, though some Member States continued to register important losses. Looking forward, global growth (excluding the EU) is set to remain at close to 3.5% over the forecast horizon. For the world as a whole, growth is projected to edge up from 3.1% in 2023 to 3.2% in 2024 and 3.3% in 2025. This is a marginally upward revision compared to the Winter Forecast. The growth outlook for the US looks better than previously expected, mainly on account of the strong end-of-2023 performance. The persistence of inflationary pressures, nevertheless, suggests that the drag of tight monetary conditions is set to continue in the short term.

Notwithstanding structural impediments (see Special Issue 4.2. China’s impressive rise and its structural slowdown ahead: implications for the global economy and the EU), a strong rebound in China’s economic activity in the first quarter lifts its near-term outlook. Merchandise trade is set to rebound, as trade elasticity converges towards the “new normal” of around 1, below historical average. The improved outlook for global merchandise trade should support EU’s external demand for goods, in turn helping to lift the prospects of the weakened manufacturing sector. EU exports of goods and services are expected to expand by 1.4% this year and to attain 3.1% in 2025, amidst some losses in market shares. Imports are also set to rebound, implying a neutral or only marginally positive contribution to EU growth of net external demand in the two forecast years. With favourable movements in terms of trade, the current account balance of the EU is expected to rise back to 3.1% of GDP in both years, in line with pre-pandemic average, though with a larger contribution of export of services.

HICP inflation in the euro area is set to decrease from 5.4% in 2023 to 2.5% in 2024, while in the EU it is expected to decrease from 6.4% to 2.7%. Already by the end of last year, the disinflationary impulse of energy prices had largely died out. As recent increases in energy commodity prices – especially crude oil – are transmitted to consumers, energy inflation is set to turn positive again, but only marginally.

Food and non-energy industrial goods have now become the primary disinflation drivers and are expected to continue detracting from inflation over the forecast horizon, reflecting receding pipeline pressures. Service prices, in contrast, have so far contributed very little to the disinflation process, reflecting still elevated wage pressures. However, relatively weak economic momentum and decelerating wage growth should allow services inflation to ease over the forecast horizon. All in all, core inflation (excluding energy and food) is expected to decline over the forecast horizon at broadly the same pace as headline inflation, remaining just slightly above. After narrowing significantly since mid-2023, dispersion of inflation within the EU is set to decline further by 2025, reflecting country-specific drivers of core inflation, including the expected wage growth, developments in productivity and unit profits. These dynamics are largely mirrored by the GDP deflator – a measure of the evolution of domestic price pressures. The deflator is set to slowdown from 6% in 2023 to 3.3% in 2024 and 2.2% in 2025, as still high but abating wage growth is offset by a return to productivity growth and a reduction in profit margins.

After a sizeable reduction in 2022, the EU government deficit in 2023 increased marginally from 3.4% to 3.5% of GDP, as the deterioration economic conditions and increased interest expenditure outweighed the reduced cost of discretionary policy. The EU government deficit is nevertheless projected to resume declining in 2024 (to 3.0%) and 2025 (to 2.9%), driven by the almost complete phase-out of energy-related measures, lower subsidies on private investment as well as the gradual improvement in economic activity.

As in 2023, eleven Member States are projected to record a general government deficit exceeding 3% of GDP in 2024, dropping to nine in 2025. The EU fiscal stance turned neutral in 2023, after significant expansion in the 2020-22 period. It is set to be contractionary in 2024 and to turn broadly neutral in 2025.

This forecast incorporates all budgetary policies that have been adopted or credibly announced and sufficiently detailed (see Box 1.2.3). Amid higher costs of servicing debt and lower nominal GDP growth, the debt-to-GDP ratio is set to stabilise this year, at 82.9% in the EU before edging up by around 0.4pps. in 2025. By the end of 2025, in most Member States the debt-to-GDP ratios are projected to be lower than in 2020 but to remain above 60% of GDP in 12 countries.

Risks originating from outside the EU have increased in recent months amid two ongoing wars in our neighbourhood and mounting geopolitical tensions. Global trade and energy markets appear particularly vulnerable. Moreover, persistence of inflation in the US may further delay rate cuts in the US, but also beyond, resulting in somewhat tighter global financial conditions. On the domestic front, EU Central Banks may also postpone rate cuts until the decline in services inflation firms. In addition, the need to reduce budget deficits and put debt ratios back on a declining path may require some Member States to pursue a more restrictive fiscal stance than currently projected for 2025, weighing on economic growth. At the same time, a decline in saving propensity could spur consumption growth, while residential construction investment could recover faster. Risks associated to climate change and the degradation of natural capital increasingly weigh on the outlook. The EU is particularly affected, as Europe is the continent experiencing the fastest increase in temperature.

You can read the full report here.

Compliments of the European Commission.The post European Commission | Spring 2024 Economic Forecast: A Gradual Expansion Amid High Geopolitical Risks first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

EACC & Member News

Blog post by Óscar Arce and David Sondermann | Over the first two decades of the currency union, labour productivity (output per worker) in the euro area has been weak, at least when compared to other advanced economies. While productivity grew annually on average by 0.6 percent from 1999 to 2019, the average pace was more than twice as fast in the United States. Productivity somewhat recovered after the pandemic, but more recently the picture changed for the worse again: In 2023, productivity in the eurozone fell by almost 1 percent while it grew by 0.5 percent in the US. We discuss the drivers of recent weak productivity growth, how it might develop and what that all means for disinflation in the euro area.

Labour productivity moves with the cycle

Some structural factors can change productivity growth. In recent times, the unexpectedly quick adoption of digital technologies during the pandemic may have pushed up productivity growth. By contrast, some external shocks, such as the severe disruption in energy markets that followed the Russian invasion of Ukraine could have weighed on it.

While it is too early to ascertain the impact of these structural factors on productivity, the recent weak economic activity is likely to have dragged it down. Indeed, productivity in the euro area typically moves quite strongly with the business cycle. During times of slow or negative economic growth, labour productivity tends to be muted as well, and it rises as the economy recovers (Chart 1).

Chart 1

Cyclicality of labour productivity

Percentage deviations from trend

Source: Eurostat, CEPR and ECB staff calculations. Notes: The cyclical component is identified with the approximate bandpass filter of Christiano and Fitzgerald (2003), identifying the business cycles between 6 and 32 quarters, and is expressed in percent deviations from trend. Peaks and troughs are taken from the CEPR chronology of euro area business cycles.

This cyclical pattern of labour productivity results from the strategy of many firms to hold on to workers even at times of dire prospects. As it can be very costly to let workers go and then rehire and retrain them when things brighten up again, hoarding labour in bad times is a rather common practice among firms. To some extent, this obeys to various European-specific labour market institutions and social preferences that give particular prominence to employment protection compared to flexibility. These preferences were also mirrored in the government-sponsored job retention schemes, as seen massively during the pandemic, which may also exacerbate the cyclical ups and downs in productivity. Recent research by ECB staff, in fact, reveals that the share of firms hoarding labour was significantly elevated during the pandemic and post-pandemic period.[1]

Moreover, in the last quarters, a number of factors may have even amplified the cyclical decline of labour productivity, reinforcing an unusual combination of a thriving job market and weak economic activity (Chart 2).

Chart 2

Employment and real GDP

(2022Q1=100)

Source: Eurostat and ECB staff calculations.

What amplifies the ups and downs of productivity?

First, the increase of profit margins in 2022/23 enabled firms to hold on to their employees despite falling revenues for longer than usual. In other words, high profit margins created financial space for firms to hoard labour. Recent ECB analysis based on a sample 2014-2023 suggests that an increase in a firm’s profit margin by 1 percentage point increases the likelihood of labour hoarding by 0.2 percentage points.[2]

Second, hiring workers became less costly in 2022/23, as real wages fell significantly. When inflation rates peaked in 2022, wage increases didn’t keep up with rising price levels. Only with a time lag nominal wage increased and inflation rates fell, so that real wages started to rise. While productivity growth has also been weak since the onset of the recent inflationary burst, real wages fell significantly more (Chart 3). The resulting gap between real wages and productivity pushed down real labour costs. Then, as the wage-productivity gap persisted, the incentives for firms to hire more workers rose. And this weighed on the average productivity per worker.[3]

Chart 3

Productivity real wage gap

(2019Q4 = 100)

Source: Eurostat and ECB calculations. Notes: wages are deflated with the private consumption deflator. A similar, albeit somewhat smaller gap emerges using the GDP deflator.

Third, the unusually strong labour force growth in the post-pandemic period helped firms to get new workers on board to address actual or expected labour shortages. Firms throughout all sectors of the economy reported increasing shortage of workers during last years (Chart 4). This has been a result of reviving demand after the pandemic but also of a more structural lack of labour supply, given the increasingly ageing population and skill gaps in many professions. At the same time, the labour force grew strongly after the pandemic (Chart 4). On the one hand, a large share of the previously inactive domestic population joined the labour force, for instance senior workers. On the other hand, the euro area labour supply benefited from strong immigration. Amid the possibility of facing acute labour shortages, firms hired much of the additional workers available, even though this happened during a time of overall subdued economic activity. As this sort of precautionary motive for hiring workers strengthened, firms likely accepted some productivity losses as a lesser disadvantage.

Chart 4

Labour force growth (LHS) and labour shortages (RHS)

(percentages)

Source: Eurostat, European Commission and ECB staff calculations. The labour shortages question is based on the survey question: “What main factors are currently limiting your production?”. Labour shortages are aggregated from manufacturing, construction, and service sector indices by using employment weights for each sector.

Fourth, lower average hours worked per person led companies to hire some additional workers to keep their labour input overall unchanged. An average person employed in the euro area worked five hours less per quarter at the end of 2023 compared to before the pandemic. This is equivalent to around 2 million full-time workers. A large part of this decline in hours has certainly been compensated at the firm-level, such as by improving processes, reducing some slack or maybe non-registered overtime. But it is plausible that firms had to step up hiring new workers to some extent to make up for the lower average hours worked. As this happened, comparing to before the pandemic, productivity per worker dropped by 0.8 percent, while productivity per hour increased by 0.6 percent over the same time.

A cyclical recovery in productivity will support disinflation

The factors described above have supported the buoyant job creation since the end of 2022. However, they are likely to provide weaker tailwinds going ahead, which in turn will support the increase in productivity. First, profit margins are already adjusting and are expected to further decline with firms absorbing the increase in nominal wages. This will reduce the firms’ financial space for hoarding employment. Second, as real wages continue to recover (Chart 3), the gap between productivity and real wage growth is closing. As a consequence, employment gets relatively more expensive, and this will be pushing down new vacancies. Third, labour shortages have come down recently, reducing the pressure to find more workers. Moreover, the labour force is likely to grow less strongly going forward, as the pool of still inactive population that could be activated has declined considerably. Fourth, while some full-time employees want to work fewer hours, this is to some extent offset by part time workers aiming to work more. In other words, the downward trend of average hours worked is likely to continue, but at a slower pace. Hence, the need for more jobs to compensate for fewer average hours worked might not continue to the same degree as it did in previous decades.

For all these reasons, labour productivity is likely to be pushed up, in addition to the usual cyclical push from the projected economic recovery. A moderate nominal wage growth path in combination with stronger productivity growth would then soften cost pressures of firms. Together with lower profit margins, this would further support the disinflation process in the euro area.

This process is implicit in the latest ECB staff macroeconomic projections. But the recovery of productivity growth should not be interpreted as an unconditional prediction; not the least because some forces unchained by the large shocks of the last four years may still alter its course in ways that are not identifiable yet.

The views expressed in each article are those of the authors and do not necessarily represent the views of the European Central Bank and the Eurosystem.

See Botelho, V. “Higher profit margins helped firms keeping labour hoarding elevated”, Economic Bulletin issue 4/2024 forthcoming.

See Botelho, V. “Higher profit margins helped firms keeping labour hoarding elevated”, Economic Bulletin issue 4/2024 forthcoming.

See Consolo, A, Foroni, C., “Drivers of employment growth in the euro area after the pandemic: a model-based perspective”, Economic Bulletin issue 4/2024 forthcoming.

Compliments of the ECB.The post ECB | Low for Long? Reasons for the Recent Decline in Productivity first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

Today, the Biden-Harris Administration issued a Notice of Funding Opportunity (NOFO) seeking proposals from eligible applicants for activities to establish and operate a CHIPS Manufacturing USA institute focused on digital twins for the semiconductor industry. Digital twins are virtual models that mimic the structure, context, and behavior of a physical counterpart. The CHIPS for America Program anticipates up to approximately $285 million for a first-of-its-kind institute focused on the development, validation, and use of digital twins for semiconductor manufacturing, advanced packaging, assembly, and test processes. The CHIPS Manufacturing USA institute is the first Manufacturing USA institute launched by the Department of Commerce under the Biden Administration.

Unlike traditional, physical research models, digital twins can exist in the cloud, which enables collaborative design and process development by engineers and researchers across the country, creating new opportunities for participation, speeding innovation, and reducing costs of research and development. Digital twin-based research can also leverage emerging technology like artificial intelligence to help accelerate the design of new U.S. chip development and manufacturing concepts and significantly reduce costs by improving capacity planning, production optimization, facility upgrades, and real-time process adjustments.

“Digital twin technology can help to spark innovation in research, development, and manufacturing of semiconductors across the country – but only if we invest in America’s understanding and ability of this new technology,” said Secretary of Commerce Gina Raimondo. “This new Manufacturing USA institute will not only help to make America a leader in developing this new technology for the semiconductor industry, it will also help train the next generation of American workers and researchers to use digital twins for future advances in R&D and production of chips.”

“Under President Biden’s leadership, we’re writing a new chapter in semiconductor manufacturing in America,” said Arati Prabhakar, Assistant to the President for Science and Technology and Director of the White House Office of Science and Technology Policy. “CHIPS R&D is about making sure American manufacturers can continue to succeed and thrive. Digital twin technology can accelerate the costly and time-consuming work to develop the next generation of robust manufacturing for this extraordinarily complicated product.”

Funded activities are expected to include, but not necessarily be limited to operational activities to run the Institute; basic and applied research related to semiconductor digital twin development; establishing and supporting shared physical and digital facilities; industry-relevant demonstration projects; and digital twin-related workforce training.

“Digital twin technology will help transform the semiconductor industry,” said Under Secretary of Commerce for Standards and Technology and National Institute of Standards and Technology (NIST) Director Laurie E. Locascio. “This historic investment in the CHIPS Manufacturing USA institute will help unite the semiconductor industry to unlock the enormous potential of digital twin technology for breakthrough discoveries. This is a prime example of how CHIPS for America is bringing research institutions and industry partners together in public private partnership to enable rapid adoption of innovations that will enhance domestic competitiveness for decades to come.”

The CHIPS Manufacturing USA institute is expected to use integrated physical and digital assets to tackle important semiconductor-industry manufacturing challenges. By establishing a regionally diverse network, the institute will foster a collaborative environment to significantly expand innovation, bring tangible benefits to both large and small to mid-sized manufacturers, engage diverse communities, and ensure robust nation-wide workforce training.

The CHIPS Manufacturing USA institute will join an existing network of seventeen Manufacturing USA institutes designed to secure the future of U.S. manufacturing through innovation, education, and collaboration.

Dr. Eric Forsythe, director, and Dr. Michael McKittrick, deputy director, CHIPS Manufacturing USA Program, will provide a briefing on details of the NOFO on May 8, 2024, at 4:00 pm ET. Webinar participants must register in advance.

On May 16, 2024, the CHIPS Manufacturing USA Program will host a one-day hybrid meeting for potential applicants for this funding opportunity. For more information and to register for this event, please visit chips.gov.

Compliments of the U.S. Department of Commerce.The post CHIPS for America Announces $285 million Funding Opportunity for a Digital Twin and Semiconductor CHIPS Manufacturing USA Institute first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

Keynote Address by Kristalina Georgieva, IMF Managing Director, at the Annual EU Budget Conference 2024.

What a pleasure to be here today, surrounded by friends, on a brief stopover between Saudi Arabia and Chile. Whenever I’m in Brussels I feel I’m at home.

And home it was for me, for seven years, working at the European Commission. Someone famous may have had seven years in Tibet, I had my seven years in Brussels—including serving as Vice President for Budget and Human Resources and hosting the Annual Budget Conference.

I know it is getting to be known in short form as ABC. I assure you, I am fully aware the EU budgetary process goes from A all the way to Z—and it is made simple only by the tireless work of the fantastic DG Budget team!

Before I dive in, one confession. I actually love budgets! To me, budgets are so much more than just numbers. They tell a story. They reveal what the true priorities are. You could say they reflect truth!

***

My remarks today will be about the importance of budgetary cohesion in Europe, about the efficiency of joint spending to solve joint problems. I want to reflect on how Europe can come together to provide essential, common public goods.

My remarks will have three parts. First, some reflections on the global environment, a tough place for trading nations. Second, some words on Next Generation EU, noting its successes so far and reflecting on initial lessons. And then, to conclude, a brief outline of my thoughts on the way forward.

Let me jump in.

***

The global environment. When we stare out at the horizon, what do we see?

I see a hint of sunshine. But I also see a dull grey sky and some dark clouds.

Let me start with the sunshine. After a global burst of inflation to levels many people have never seen in their lifetimes, it looks like the ECB’s tight monetary policy is doing its work.

This is something I need to say carefully because it’s not over yet. But, yes, it looks promising: inflation down from its disturbingly high peaks and no deep recessions in Europe.

Never forget though, that the last mile can be the hardest. No longer will the major central banks be marching in lockstep, as they did during the recent rate-hiking cycle. No. From now on, each currency zone will have to chart its own path. An interest rate divergence looms, and maybe some exchange rate movements too.

We save the champagne for later.

Next, the grey skies. Two problems:

Problem one: growth. Our World Economic Outlook shows the global economy converging back to a rather weak trend rate of growth. Yes, the US economy still looks like it’s firing on all cylinders, but that is unlikely to last. In China, real-estate issues weigh on the outlook. In Europe, productivity growth lags behind, reflecting much less private investment in new technologies than in the United States. This is why we say it is vital to pursue structural reforms and scale-up innovation and investment. Europe needs faster productivity growth, and that means reforms—including transformational ones in the energy and digital arenas, and the completion of the single market.

Problem two: debt. After two massive shocks—the pandemic and the energy-supply shock caused by Russia’s invasion of Ukraine—many countries are shouldering very heavy public debt burdens. This is why we say many countries must now pursue judicious, well-articulated medium-term fiscal consolidation to rebuild buffers—appropriately tailored to country specifics, of course.

Low growth, high debt. Not a great place from which to begin a big push to develop clean energy supply and fight climate change. But let us be clear: if we do not win the fight against climate change, all of humanity together, we will all suffer.

Dark clouds. Truly, we know how to be our own worst enemies. I am speaking of geopolitics. Does humankind march forward with a united front? Far from it.

Instead, we live in a period of tensions, where bilateral fights and transactional approaches threaten the rules-based world order that has served us so well since the end of the Second World War.

My job as head of the IMF is to defend and promote a well-functioning, rules-based, and integrated global economy—in which trade and capital flows are the transmission lines of prosperity. For five years I have done so, and—mark my words—I will continue to do it in my second term.

We at the IMF are worried about the bilateral trade fights, the gaming of the rules, the raising of trade barriers, the economic coercion. They are harmful to global growth and hurt our capacity to solve global problems. We do not make national policy—and certainly not national security policy. What we do is we take the vital signs of our members’ economies and quantify the costs and the benefits of the choices our members make. We hold up a mirror.

And my goodness. Right now, the reflection in the mirror is not pretty.

One example. IMF research shows that since Russia’s invasion of Ukraine, trade growth between countries in politically distant blocs has slowed by 2.4 percentage points more than trade among those that are closely aligned. This will have costs.

The policy message is clear. Global economic policymaking needs a calm voice, a cool mind, a steady temperament.

As I will argue, the world needs a strong and cohesive Europe. To defend the rules-based order. To show the world how much is gained by working together. To lead by example.

Let me go to Part II.

***

The European Union. Twenty-seven sovereign states in a marriage like no other. A vast body of shared law. A commitment to democracy. A clear separation of power into national competences and central competences. Four freedoms—the freedom of movement of goods, services, people, capital. A single market that, no matter how imperfect, actually works, helping bring ever-greater prosperity to almost 450 million people. Convergence. A union of hope.

Four further things to note:

One, Europe is a trading power. Relative to GDP, the EU exports and imports a lot. More trade openness than the United States. In some EU countries, much more. As such, one can get knocked around by events abroad. To handle this, Europe needs to be strong.

Two, much of Europe’s strength derives from its cohesion. Since the Schumann Declaration of May 1950 proposing the European Coal and Steel Community, 22 countries have been welcomed into the union. Today, 20 EU member states share a common currency. After the dollar, the euro is the world’s Number Two reserve currency. Not bad for only 25 years!

Three, the EU budget sits at the heart of European cohesion. For decades, the Multiannual Financial Framework—the MFF—has channeled a steady supply of fuel into Europe’s convergence engine. I think of the structural and cohesion funds and all the good they have done for “the country I know best.” And for the rest.

Four, when we think of fiscal policy, we cannot forget that the EU is not one country. No, unlike the other two superpowers, the EU has 27 national debt stocks. There is no mandate to build a “United States of Europe.” That is the democratic will of the people.

Nonetheless, in the early months of 2020, as a new virus hit us with no regard for borders, something new was born.

I refer, of course, to Next Generation EU.

If you ask me, July 2020 will go down in history as a time of profound European cohesion. Finding a solution that could reasonably be deemed consistent with the Treaties, leaders came together to craft a powerful European response to a common and grave problem.

Basically, NGEU represented a major expansion of the EU budget, financed by common borrowing, with disbursements running until the end of 2026.

This was unprecedented. Up to 800 billion euros in bond-financed EU support to national budgets. Not only to recover from the pandemic, but to help finance digitalization and the Green Deal and help incentivize much-needed structural reforms to lift potential growth. To send a deliberate signal of solidarity, including solidarity with the tourist economies of Southern Europe so hard-hit by the pandemic, as well as the less-wealthy member states.

To show financial markets that the EU stands together as one. Remember, just the announcement of NGEU had a powerful calming effect on financial markets. The top credit rating. Debt management. A risk-management framework. A Chief Risk Officer—in fact, I see her here today!

On the expenditure side, I am delighted that NGEU has taken forward lessons from the times when I was responsible for the EU budget. Back then, we introduced a framework for a Budget Focused on Results, to add coherence in three areas:

What to spend on—a focus on areas where the EU budget could have maximum added value. Cross-border infrastructure and humanitarian aid, to mention just two.

How to spend—not just grants, but private sector co-investment.

How to communicate—transforming the EU budget from something boring into something with a story.

I am very happy to see that many aspects of the Budget-for-Results strategy live on. NGEU has built on it by taking a direct performance-based approach, where disbursements to national budgets are made entirely based on actual milestones and targets achieved. X number of new wind turbines. Y number of new solar farms. Z number of new internet connections. And, perhaps most importantly of all, difficult but necessary structural reforms, incentivized by real money. And it is working. Lessons learned, lessons implemented.

So far so good.

***

So: what comes next?

It may not be as dramatic as a pandemic, but the challenges the EU faces going forward also shout out for a concerted response. In a time of geopolitical and economic uncertainties, policy choices will matter deeply. And these choices, in turn, will fundamentally shape the next MFF. In a time of higher interest rates and squeezed budgets, we still need to find ways to provide critical common public goods, and to do so cost-effectively.

One of the clearest cases for doing more together can be made in the areas of climate and energy security.

As a new IMF paper which comes out at the end of the month will show, Europe’s climate and energy security objectives are fully complementary. For those of you looking for a good read, please watch out for a paper called “The Energy Security Gains from Strengthening Europe’s Climate Action.”

As the recent gas-supply shock showed, as long as Europe is dependent on imported fossil fuels, it will remain vulnerable. In just one year—2022—the EU’s fossil-fuel import bill doubled, to over 5 percent of GDP. Greening Europe’s energy supply is the best solution for energy security. No one can shut off the wind or the sun!

We know, however, that the size of the additional investments needed to get from here to there—to net zero emissions by 2050 and to an energy-secure Europe—will be huge. Ensuring that this transition happens in the face of countless other fiscal pressures requires an intelligent approach.

Let’s think of the facts.

The cost of abating one ton of CO2 emissions today varies widely across countries and sectors. In some sectors, even if you could throw a ton of money at the problem, you might not change the result much due to supply constraints or the absence of alternative technologies.

It becomes vital to do what you can, wherever you can, as cost effectively as possible. This involves figuring out where you get the biggest bang for your buck in terms of reducing emissions. I see this as an area where, absolutely, there is a case for a strong, coordinated, centralized EU role.

Once again, the EU needs to come together—with a focus on helping to surge public and private investments to the most cost-effective and impactful areas.

There is an equally clear case for the EU to play a stronger role in areas where there are coordination failures, externalities, risks to the single market. I am thinking of the need to ensure that cross-border investment in electricity grids happens. I am thinking about the need to promote R&D in new “clean tech” for hard-to-abate sectors. I am thinking how important it is to do so without bending the state-aid rules and distorting the single market.

All of these efforts would also go a long way towards achieving the EU’s energy security goals. Win-win.

***

I will close with one simple, clear request—and I will say it loudly.

Please put in place a new Multiannual Financial Framework that is commensurate to the huge challenges that lie ahead. I ask you all: please do not just do what may be popular at home, do what is right for Europe!

Europe is stronger together, Europe is richer together, Europe matters more together.

Thank you all for your attention!

Compliments of the IMF.The post IMF | Georgieva: the World Needs a Strong, Cohesive Europe first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

On May 1, U.S. Secretary of Commerce Gina Raimondo celebrated World Trade Month by reaffirming the Biden-Harris Administration’s commitment to creating a more sustainable and inclusive economy through international trade.

“International trade is essential to our nation’s economic growth and helps Americans build more resilient businesses and communities,” said Secretary Raimondo. “Throughout World Trade Month, the Commerce Department will celebrate and reaffirm the Biden-Harris Administration’s enduring commitment to deepening our economic cooperation with allies, bolstering supply chain resilience, ensuring a level playing field for American workers and businesses, and attracting foreign direct investment that creates good-paying jobs in the United States.”

Observed every May, World Trade Month is an opportunity to highlight the many ways that international trade spurs innovation and strengthens the U.S. economy by creating pathways to prosperity across the country, including for small and medium sized enterprises, minority and women-owned businesses, and rural communities.

Over the course of the month, the U.S. Department of Commerce’s International Trade Administration (ITA) will both host and participate in a variety of in-person and virtual events, trade missions and programming to help U.S. businesses compete and win in the global economy.

The full calendar of World Trade Month events and other resources, including the National Export Strategy, can be found on trade.gov/world-trade-month.

Compliments of the U.S. Department of Commerce.The post U.S. Department of Commerce Celebrates World Trade Month 2024 first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

The European Commission received today the final recommendations of the High-Level Expert Group on scaling up sustainable finance in low-and middle-income countries (HLEG), in the presence of International Monetary Fund Managing Director Kristalina Georgieva.

Since 2022, emerging markets have experienced the worst ever capital outflows. The report provides concrete and innovative actions the Commission can take to mobilise private capital for sustainable investments in Global Gateway partner countries.

It outlines ten recommendations, with a focus on establishing an enhanced strategic engagement model with partner countries while ensuring increased flexibility in leveraging the EU’s external financial support instruments. Furthermore, the HLEG recommends innovative solutions to mobilise private capital and the increase of fiscal resources for sustainable investments, alongside measures to strengthen the size and depth of local sustainable capital markets.

The recommendations in the report feed into the wider debate on how to crowd in more private funding for sustainable development in partner countries through innovative models, in a context of constrained public funds and limits to concessional finance. For this to happen, partner countries need to continue working on developing their sustainable finance ecosystems and sustainable capital markets. In parallel, ongoing discussions of the mandates of multilateral development banks and development financial institutions will also be instrumental to bring the private sector on board.

European Commissioner for International Partnerships Jutta Urpilainen said: “Sustainable finance in low- and middle-income countries has to be scaled up given the current constraints on public finance and the limited availability of concessional finance. This has been a priority of my mandate under the Global Gateway investment strategy. This report sends a strong signal to our partners that the European Commission is committed to mobilise private capital at scale for sustainable investment for low- and middle-income countries.”

European Commissioner for Neighbourhood and Enlargement Olivér Várhelyi added: “Mobilising sustainable investments in our partner countries has been a key priority during my mandate. Our ambitious Economic & Investment Plans in the Western Balkans, Eastern Partnership, and Southern Neighbourhood have been instrumental in this respect. These projects are expected to foster nearly EUR 50 billion of investments in vital sectors covering our partners’ development needs: sustainable connectivity, human capital, competitiveness and inclusive growth, the twin green and digital transitions, and more. These recommendations will help our partners amid the current economic and geopolitical volatile landscape to develop further.”

International Monetary Fund Managing Director Kristalina Georgieva stated: “Constraints on public finance coupled with high interest rates worldwide are making it ever more difficult to close the investment gap for low- and middle-income countries. This report is a valuable contribution to the ongoing international reflection on how to mobilise private capital for these countries and resonates with the IMF’s own ongoing work in this area. The IMF will continue to work closely with the European Commission in supporting our partners in developing their capital markets, attracting private investors, and overcoming financial obstacles to secure a bright, more prosperous future for all.”

Background

The HLEG was mandated by the European Commission to identify the challenges and opportunities of sustainable finance in in low- and middle-income countries, and to provide recommendations on concrete and transformative actions the European Commission could take to support sustainable finance in these countries. It brought together a diverse group of international experts representing a broad range of expertise, both financial and non-financial, including EU cross-border investors, local investors, local businesses, civil society, standard-setters and academia. Established in September 2022, the HLEG held twelve meetings in both plenary and working group format. The recommendations are the output of over 18 months of dedicated work.

Global Gateway represents the European Union’s effort reduce the worldwide investment disparity and boost smart, clean and secure connections in digital, energy and transport sectors, and to strengthen health, education and research systems. It provides sustainable investment opportunities to enhance the prosperity and security of our global partners and Europe alike. The Global Gateway strategy embodies a collaborative approach that brings together the European Union, EU Member States, and European development finance institutions. The aim is to mobilise up to €300 billion in public and private investments from 2021 to 2027, creating essential links rather than dependencies, and closing the global investment gap.

Compliments of the European Commission.The post European Commission | Global Gateway: Scaling up Sustainable Finance in EU Partner Countries first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

Announcements include draft guidance documents, a draft plan for international standards, and a new measurement program opening for public comment

The U.S. Department of Commerce announced today, following the 180-day mark since President Biden’s Executive Order (EO) on the Safe, Secure and Trustworthy Development of AI, several new announcements related to the EO. The Department’s National Institute of Standards and Technology (NIST) has released four draft publications intended to help improve the safety, security and trustworthiness of artificial intelligence (AI) systems. NIST has also launched a challenge series that will support development of methods to distinguish between content produced by humans and content produced by AI. In addition to NIST’s publications, Commerce’s U.S. Patent and Trademark Office (USPTO) is publishing a request for public comment (RFC) seeking feedback on how AI could affect evaluations of how the level of ordinary skills in the arts are made to determine if an invention is patentable under U.S. law, and earlier this year released guidance on the patentability of AI-assisted inventions.

“In the six months since President Biden enacted his historic Executive Order on AI, the Commerce Department has been working hard to research and develop the guidance needed to safely harness the potential of AI, while minimizing the risks associated with it,” said U.S. Secretary of Commerce Gina Raimondo. “The announcements we are making today show our commitment to transparency and feedback from all stakeholders and the tremendous progress we have made in a short amount of time. With these resources and the previous work on AI from the Department, we are continuing to support responsible innovation in AI and America’s technological leadership.”

The NIST publications cover varied aspects of AI technology: The first two are guidance documents designed to help manage the risks of generative AI — the technology that enables chatbots and text-based image and video creation tools — and serve as companion resources to NIST’s AI Risk Management Framework (AI RMF) and Secure Software Development Framework (SSDF), respectively. A third NIST publication offers approaches for promoting transparency in digital content, which AI can alter; the fourth proposes a plan for developing global AI standards. These publications are initial drafts, which NIST is publishing now to solicit public feedback before submitting final versions later this year.

“For all its potentially transformative benefits, generative AI also brings risks that are significantly different from those we see with traditional software,” said Under Secretary of Commerce for Standards and Technology and NIST Director Laurie E. Locascio. “These guidance documents will not only inform software creators about these unique risks, but also help them develop ways to mitigate the risks while supporting innovation.”

USPTO is publishing an RFC seeking feedback on how AI could affect evaluations they make as they determine whether an invention is patentable under U.S. law. For example, the use of AI poses questions as to what qualifies as prior art and the assessment of the level of skill of a person having ordinary skill in the art. USPTO expects the responses to the RFC will help them evaluate the need for further guidance on these matters, aid in the development of any such guidance, and help inform USPTO’s work in the courts and in providing technical advice to Congress.

“As AI assumes a larger role in innovation, we must encourage the responsible and safe use of AI to solve local and world problems and to develop the jobs and industries of the future, while ensuring AI does not derail the critical role IP plays in incentivizing human ingenuity and investment,” said Under Secretary of Commerce for Intellectual Property and Director of the USPTO Kathi Vidal. “This work builds on our inventorship guidance, which carefully set forth when the USPTO will issue a patent for AI-assisted innovations, and our continuing policy work at the intersection of AI and all forms of IP.”

More information on the announcements being made today can be found below. All four of the NIST publications are initial public drafts, and NIST is soliciting comments from the public on each by June 2, 2024. Instructions for submitting comments can be found in the respective publications.

Mitigating the Risks of Generative AI

The AI RMF Generative AI Profile (NIST AI 600-1) can help organizations identify unique risks posed by generative AI and proposes actions for generative AI risk management that best aligns with their goals and priorities. Developed over the past year and drawing on input from the NIST generative AI public working group of more than 2,500 members, the guidance document is intended to be a companion resource for users of NIST’s AI RMF. The AI Profile guidance document centers on a list of 13 risks and more than 400 actions that developers can take to manage them.

The 13 risks include issues such as easier access to information related to chemical, biological, radiological or nuclear weapons; a lowered barrier to entry for hacking, malware, phishing, and other cybersecurity attacks; and the production of hate speech and toxic, denigrating or stereotyping content. Following the detailed descriptions of these 13 risks is a matrix of the 400 actions that developers can take to mitigate the risks.

Reducing Threats to the Data Used to Train AI Systems

The second publication, Secure Software Development Practices for Generative AI and Dual-Use Foundation Models (NIST Special Publication (SP) 800-218A), is designed to be used alongside the SSDF (SP 800-218). While the SSDF is broadly concerned with securing the software’s lines of code, this companion resource expands the SSDF to help address concerns around malicious training data adversely affecting generative AI systems.

In addition to covering aspects of the training and use of AI systems, the new companion resource offers guidance on dealing with the training data and data collection process, including a matrix that identifies potential risk factors and strategies to address them. Among other recommendations, the document suggests analyzing training data for signs of poisoning, bias, homogeneity and tampering.

Reducing Synthetic Content Risks

Accompanying generative AI’s development has been the rise of “synthetic” content, which has been created or altered by AI. Offering technical approaches for promoting transparency in digital content is the goal of NIST’s new draft publication, Reducing Risks Posed by Synthetic Content (NIST AI 100-4). This publication informs, and is complementary to, a separate report on understanding the provenance and detection of synthetic content that AI EO Section 4.5(a) tasks NIST with providing to the White House.

NIST AI 100-4 lays out methods for detecting, authenticating and labeling synthetic content, including digital watermarking and metadata recording, where information indicating the origin or history of content such as an image or sound recording is embedded in the content to assist in verifying its authenticity. The report does not focus only on the dangers of synthetic content; it is intended to reduce risks from synthetic content by understanding and applying technical approaches for improving the content’s transparency, based on use case and context.

Global Engagement on AI Standards

AI systems are transforming American society and around the world. A Plan for Global Engagement on AI Standards (NIST AI 100-5) is designed to drive the worldwide development and implementation of AI-related consensus standards, cooperation and coordination, and information sharing.

The draft invites feedback on areas and topics that may be urgent for AI standardization. Such topics, which are ready for standardization, include mechanisms for enhancing awareness of the origin of digital content, whether authentic or synthetic; and shared practices for testing, evaluation, verification and validation of AI systems. Other topics may require more scientific research and development to establish a foundational scientific understanding about critical components of the potential standard.

NIST GenAI

In addition to the four documents, NIST is also announcing NIST GenAI, a new program to evaluate and measure generative AI technologies. The program is part of NIST’s response to the Executive Order, and its efforts will help inform the work of the U.S. AI Safety Institute at NIST.

The NIST GenAI program will issue a series of challenge problems designed to evaluate and measure the capabilities and limitations of generative AI technologies. These evaluations will be used to identify strategies to promote information integrity and guide the safe and responsible use of digital content. One of the program’s goals is to help people determine whether a human or an AI produced a given text, image, video or audio recording. Registration opens in May for participation in the pilot evaluation, which will seek to understand how human-produced content differs from synthetic content. More information about the challenge and how to register can be found on the NIST GenAI website.

USPTO RFC on Patentability

The full Federal Register Notice can be found HERE. Comments are due July 29, 2024. Please see the Federal Register Notice for instructions on submitting comments.

To incentivize, protect, and encourage investment in innovations made possible through the use of artificial intelligence (AI), and to provide the clarity to the public on the patentability of AI-assisted inventions, the USPTO has previously published guidance in the Federal Register.

Compliments of the U.S. Department of Commerce.The post U.S. Department of Commerce Announces New Actions to Implement President Biden’s Executive Order on AI first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

The Commission has today adopted proposals for Council decisions on the signing and provisional application, as well as on the conclusion of the Association Agreement between the EU and Andorra and San Marino, respectively. This represents a key step towards the ratification of the agreement, while marking a significant milestone in EU efforts to develop a special relationship with neighbouring countries.

The Association Agreement will allow Andorra and San Marino to participate in the EU’s internal market and enhance cooperation in other policy areas. Their access to the internal market will become comparable to that enjoyed by Norway, Iceland and Liechtenstein under the Agreement on the European Economic Area. Ultimately, this responds to the two countries’ ambition in building closer relations with the EU.

The Association Agreement is based on the following key elements:

> It provides for the participation of the two countries in a homogenous extended internal market under equal conditions of competition and respect of the same rules.

> Access to the internal market in financial services will be progressive and will depend on a successful audit of the robustness of the associated States’ regulatory and supervisory frameworks. The European Supervisory Authorities will play a central role in the auditing process.

> The Association Agreement establishes a framework to develop and promote dialogue and cooperation in areas of common interest, such as research and development, education, social policy, the environment, consumer protection, culture or regional cooperation.

> It introduces a coherent, effective, and efficient institutional framework, including:

–the consistent interpretation and application of the Association Agreement in line with the case-law of the European Court of Justice; and

— a dispute settlement mechanism with the European Court of Justice as the ultimate arbiter for disputes on the interpretation and application of the Association Agreement.

> In line with the 2014 negotiating directives, the Association Agreement takes into account the particular situation of Andorra and San Marino as well as their specificities, arising from their relations of proximity with their neighbouring EU Member States, their size, including that of their populations. This is reflected in a number of adjustments as well as in several transitional periods for the implementation and application of parts of the EU acquis.

Next Steps

Once the Council gives its green light, the EU, Andorra and San Marino can sign the Association Agreement and then pass it to the European Parliament for consent. After the consent by the European Parliament, the Council can adopt a decision on its conclusion. Once Andorra and San Marino have also completed their ratification procedures, the Association Agreement can enter into force.

Background

On 16 December 2014, the General Affairs Council authorised the opening of negotiations for an Association Agreement with Andorra, Monaco and San Marino. The Commission took over the responsibility of these negotiations in January 2022.

In its conclusions adopted in June 2022, the Council called on the Commission to finalise the negotiations by the end of 2023. Between March 2022 and December 2023, 49 negotiating sessions were held and significant progress was made, leading to the conclusions of negotiations at negotiators level in December 2023.

Compliments of the European Commission.The post Commission proposes Association Agreement with Andorra and San Marino to the Council first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

The Commission has adopted an amendment to the 2023-24 Work Programme of Horizon Europe, the EU’s research and innovation programme. The amendment mobilises previously unallocated Horizon Europe funding to increase the 2024 budget by nearly €1.4 billion to a total of €7.3 billion. This amendment includes an investment of nearly €650 million in the EU Missions aiming to contribute to solving some of the challenges facing Europe, for example, making more than 100 cities climate neutral, a New European Bauhaus facility, as well as experimental actions opening EU research and innovation opportunities to more newcomers, among other novelties.

Some of the main features of this update of the Horizon Europe Work Programme include:

EU Missions

The EU will invest €648 million in 2024 in research and innovation activities underpinning the EU Missions. The EU Missions cover five areas and are a novelty brought by Horizon Europe to bring concrete solutions to some of our greatest challenges. They have ambitious goals and will deliver concrete results by 2030. The new actions for 2024 should result in restoring at least 25 000 km of free-flowing rivers, Climate City Contracts with more than 100 cities, 100 living labs and lighthouses leading the transition towards healthy soils, local and regional authorities better prepared to face climate-related risks, better cancer diagnosis and support to young cancer sufferers.

New European Bauhaus

The New European Bauhaus (NEB) aims to bring the benefits of the European Green Deal into people’s daily lives and living spaces. In the three years since its launch, the NEB has provided solutions to concrete problems. Examples include the TOVA project from Spain that developed a 3D printing technique with earth to provide architectural solutions for sustainable, affordable, community-based housing. Another example is the WATSUPS project from Belgium that creates a new public space alongside the river Dyle to mitigate the risk of gentrification. These solutions are rooted in research and innovation that place the Europeans at the heart of the green transformation.

A new NEB Facility will ensure that Europe continues to make most of this potential. It brings multi-annual budget support for 2025-2027 through two pillars, a research and innovation part to develop new ideas and a roll-out part to scale-up such solutions. The amended Horizon Europe work programme 2023-24 allocates €20 million to preparing the ground for the implementation of the NEB Facility.

Experimental actions to attract newcomers

This amendment includes a package of new experimental actions to reinforce the openness of the programme, support the goals of the EU Missions and foster young researchers’ careers. They will test new approaches in view of preparations for the last three years of Horizon Europe as well as of its future successor programme.

The actions include four open topics giving researchers more freedom to focus their work on a subject they choose with a total budget of €76 million in Horizon Europe Clusters addressing ‘Health’, ‘Climate, energy and mobility’ and ‘Food, Bioeconomy, Natural Resources, Agriculture and Environment’. An experimental action of €15 million for the EU Missions will make knowledge institutions such as universities or research organisations focal points of local transdisciplinary research and innovation activities with European outreach. In addition, the NEB call ‘Transforming neighbourhoods, making them beautiful, sustainable, and inclusive’ also aims to attract newcomers to the programme to maximise impact. Finally, €20 million will support talent ecosystems for attractive early research careers.

Cultural Heritage

The amendment also dedicates €48 million to the European Collaborative Cloud for Cultural Heritage. This new digital collaborative space will support cultural heritage institutions and researchers as well as the cultural and creative industries to reap the benefits of the digital transition. It will complement the common European Data Space for Cultural Heritage (the Data Space) funded under the Digital Europe programme.

Pandemic preparedness

The COVID-19 pandemic highlighted the challenges faced by European health care systems in detecting, preventing, fighting and managing outbreaks of infectious diseases. To help equip Europe for potential future pandemics, the amended work programme includes an investment of €50 million for a European Partnership for pandemic preparedness.

Paving the way for 2025

Calls for 2025 are also included in the amendment to ensure continuity of certain recurrent actions, such as the Marie Skłodowska-Curie Actions (MSCA) and ‘Teaming for Excellence’ and ‘ERA (European Research Area) Fellowships’ in the ‘Widening participation and spreading excellence’ and ‘Reforming and Enhancing the European R&I system’ part. The Commission plans to roll out the full range of actions for 2025 in a dedicated work programme in 2025.

Background

Horizon Europe is the EU’s research and innovation programme for 2021-27. Originally working with €95.5 million over seven years, the European Council decided to reduce its budget by €2.1 billion as part of the mid-term revision of the EU’s long-term budget to allow the Union to finance other urgent priorities such as aid to Ukraine. The cut has been reduced by €100 million stemming from the re-use of decommitments, therefore, the reduction in 2025-27 will amount to €2 billion.

The 2023-24 Horizon Europe work programme was adopted on 6 December 2022 and first amended on 31 March 2023. It is based on Horizon Europe’s Strategic Plan 2021-2024, adopted in March 2021, which was co-designed with stakeholders, the European Parliament and the Member States.

Today’s amendment rolls out the investment for the EU Missions, which had been held back from the original work programme 2023-24 to enable the implementation of the Communication “EU Missions two years on: assessment of progress and way forward”, adopted on 19 July 2023.

Compliments of the European Commission.The post Commission Mobilizes Research and Innovation Funding for the Green and Digital Transitions first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.

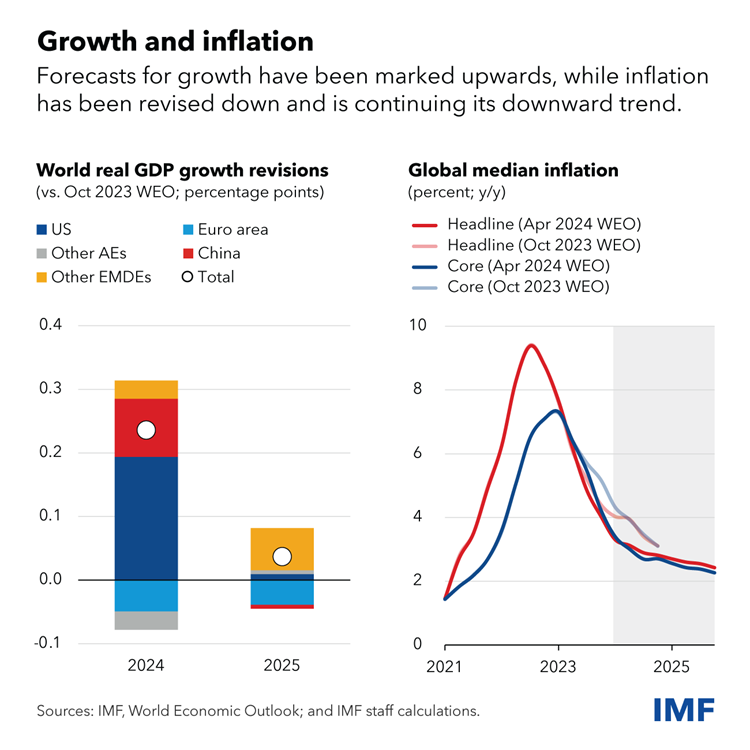

Despite gloomy predictions, the global economy remains remarkably resilient, with steady growth and inflation slowing almost as quickly as it rose. The journey has been eventful, starting with supply-chain disruptions in the aftermath of the pandemic, an energy and food crisis triggered by Russia’s war on Ukraine, a considerable surge in inflation, followed by a globally synchronized monetary policy tightening.

Global growth bottomed out at the end of 2022, at 2.3 percent, shortly after median headline inflation peaked at 9.4 percent. According to our latest World Economic Outlook projections, growth this year and next will hold steady at 3.2 percent, with median headline inflation declining from 2.8 percent at the end of 2024 to 2.4 percent at the end of 2025. Most indicators continue to point to a soft landing.

We also project less economic scarring from the crises of the past four years, although estimates vary across countries. The US economy has already surged past its prepandemic trend. But we now estimate that there will be more scarring for low-income developing countries, many of which are still struggling to turn the page from the pandemic and cost-of-living crises.

Resilient growth and rapid disinflation point toward favorable supply developments, including the fading of energy price shocks, and a striking rebound in labor supply supported by strong immigration in many advanced economies. Monetary policy actions have helped anchor inflation expectations even if its transmission may have been more muted, as fixed-rate mortgages became more prevalent.

Despite these welcome developments, numerous challenges remain, and decisive actions are needed.

Inflation risks remain

Bringing inflation back to target should remain the priority. While inflation trends are encouraging, we are not there yet. Somewhat worryingly, progress toward inflation targets has somewhat stalled since the beginning of the year. This could be a temporary setback, but there are reasons to remain vigilant. Most of the good news on inflation came from the decline in energy prices and in goods inflation. The latter has been helped by easing supply-chain frictions, as well as by the decline in Chinese export prices. But oil prices have been rising recently in part due to geopolitical tensions and services inflation remains stubbornly high. Further trade restrictions on Chinese exports could also push up goods inflation.

Economic divergences widen

The resilient global economy also masks stark divergence across countries.

The strong recent performance of the United States reflects robust productivity and employment growth, but also strong demand in an economy that remains overheated. This calls for a cautious and gradual approach to easing by the Federal Reserve. The fiscal stance, out of line with long-term fiscal sustainability, is of particular concern. It raises short-term risks to the disinflation process, as well as longer-term fiscal and financial stability risks for the global economy. Something will have to give.

Growth in the euro area will rebound but from very low levels, as past shocks, and tight monetary policy weigh on activity. Continued high wage growth and persistent services inflation could delay the return of inflation to target. However, unlike in the United States, there is little evidence of overheating, and the European Central Bank will need to carefully calibrate the pivot toward monetary easing to avoid an inflation undershoot. While labor markets appear strong, that strength could prove illusory if European firms have been hoarding labor in anticipation of a pickup in activity that does not materialize.

China’s economy remains affected by the downturn in its property sector. Credit booms and busts never resolve themselves quickly, and this one is no exception. Domestic demand will remain lackluster unless strong measures address the root cause. With depressed domestic demand, external surpluses could well rise. The risk is that this will further exacerbate trade tensions in an already fraught geopolitical environment.

Many other large emerging market economies are performing strongly, sometimes benefiting from a reconfiguration of global supply chains and rising trade tensions between China and the US. These countries’ footprint on the global economy is increasing.

Policy path

Going forward, policymakers should prioritize measures that help preserve or even enhance the resilience of the global economy.

The first such priority is to rebuild fiscal buffers. Even as inflation recedes, real interest rates remain high and sovereign debt dynamics have become less favorable. Credible fiscal consolidations can help lower funding costs, improve fiscal headroom and financial stability. Unfortunately, fiscal plans so far are insufficient and could be derailed further given the record number of elections this year.

Fiscal consolidations are never easy but it is best not to wait until markets dictate their conditions. The right approach is to start now, gradually, and credibly. Once inflation is under control, credible multiyear consolidations will help pave the way for further monetary policy easing. The successful 1993 US fiscal consolidation and monetary accommodation episode comes to mind as an example to emulate.

The second priority is to reverse the decline in medium term growth prospects. Some of that decline comes from increased misallocation of capital and labor within sectors and countries. Facilitating faster and more efficient resource allocation will boost growth. For low-income countries, structural reforms to promote domestic and foreign direct investment, and to strengthen domestic resource mobilization, will help lower borrowing costs and reduce funding needs. These countries also must improve the human capital of their large young populations, especially as the rest of the world is aging rapidly.

Artificial intelligence also gives hope for boosting productivity. It may do so, but the potential for serious disruptions in labor and financial markets is high. Harnessing the potential of AI for all will require that countries improve their digital infrastructure, invest in human capital, and coordinate on global rules of the road.

Medium-term growth prospects are also harmed by rising geoeconomic fragmentation and the surge in trade restrictive and industrial policy measures. Trade linkages are already changing as a result, with potential losses in efficiency. The net effect could well be to make the global economy less, not more, resilient. But the broader damage is to global cooperation. It is still time to reverse course.

Third, a great achievement of the past few years has been the strengthening of monetary, fiscal and financial policy frameworks especially for emerging market economies. This has helped make the global financial system more resilient and avoid a permanent resurgence of inflation. Going forward, it is essential to preserve these improvements. That includes protecting the hard-won independence of central banks.

Lastly, the green transition requires major investments. Cutting emissions is compatible with growth and activity has become much less emission-intensive in recent decades. But emissions are still rising. Much more needs to be done and done quickly. Green investment has expanded at a healthy pace in advanced economies and China. The greatest effort must now be made by other emerging market and developing economies, which must massively increase their green investment growth and reduce their fossil fuel investment. This will require technology transfer by other advanced economies and China, as well as substantial private and public financing.

On these questions, as well as on so many others, multilateral frameworks and cooperation remain essential for progress.

—This blog by Pierre-Olivier Gourinchas is based on Chapter 1 of the April 2024 World Economic Outlook.

Compliments of the IMF.The post IMF | Global Economy Remains Resilient Despite Uneven Growth, Challenges Ahead first appeared on European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources.